Contents

Overview of Embedded Finance in E-commerce Platforms

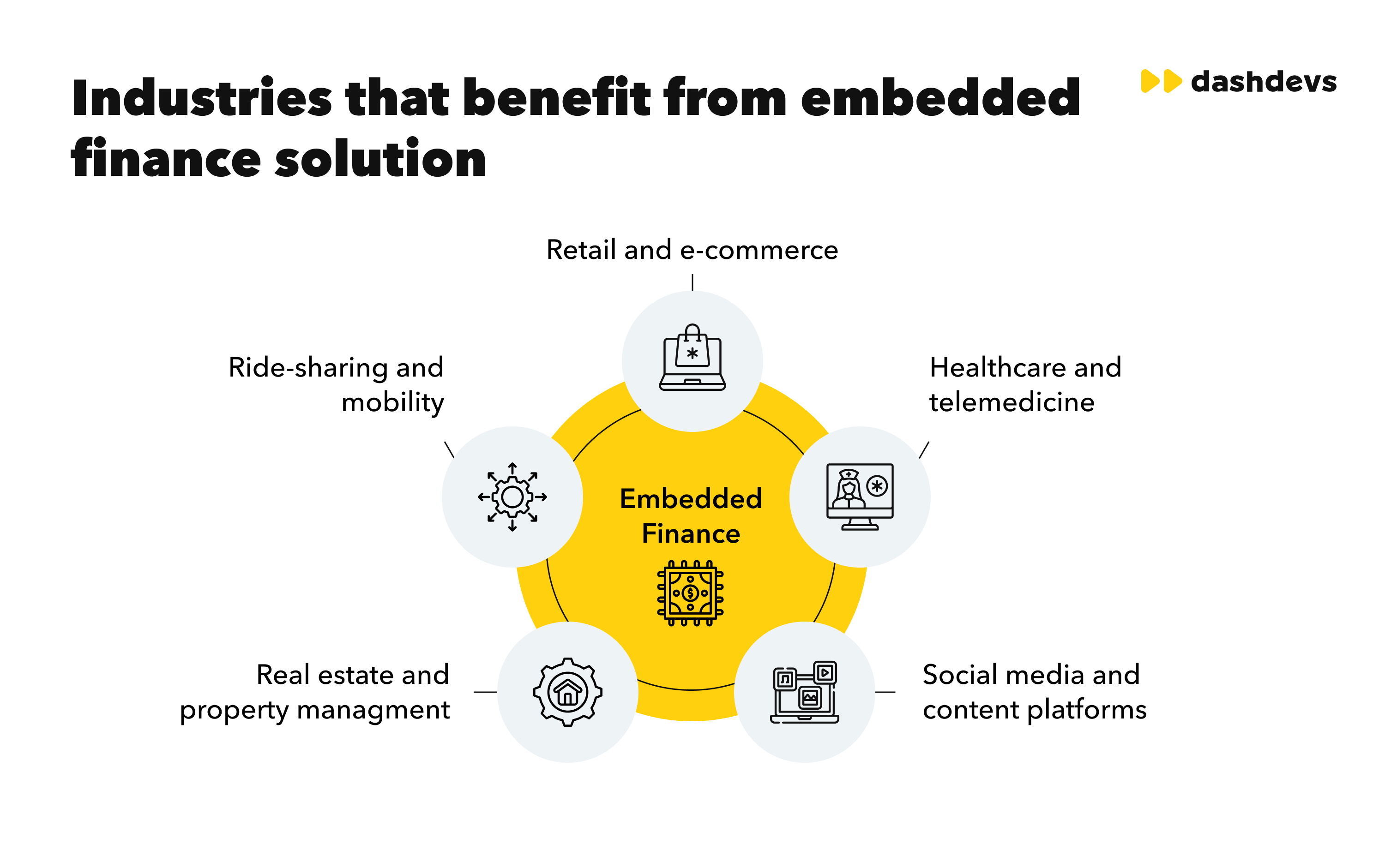

What are the most effective examples of embedded finance in e-commerce platforms? – Embedded finance refers back to the integration of monetary companies immediately into non-financial platforms, similar to e-commerce web sites, to offer a seamless and enhanced consumer expertise. This integration permits customers to entry monetary companies like funds, loans, insurance coverage, and investments with out leaving the platform.

Significance of Embedded Finance for Enhancing Consumer Expertise

Embedded finance performs an important function in enhancing the consumer expertise on e-commerce platforms by simplifying the cost course of, providing personalised monetary merchandise, and rising comfort for patrons. By offering monetary companies throughout the platform, customers can full transactions extra effectively and securely, resulting in larger buyer satisfaction and loyalty.

How Embedded Finance is Reshaping Conventional E-commerce Fashions

Embedded finance is reshaping conventional e-commerce fashions by remodeling them into complete monetary ecosystems. E-commerce platforms are now not simply locations to purchase merchandise but additionally hubs for accessing a variety of monetary companies. This shift permits platforms to seize extra worth from prospects, enhance engagement, and create new income streams past simply promoting merchandise.

Advantages of Embedded Finance in E-commerce

Embedded finance presents quite a few benefits when built-in into e-commerce platforms, revolutionizing the best way transactions are dealt with and enhancing the general consumer expertise.

Streamlined Fee Processes

One of many key advantages of embedded finance in e-commerce is the power to streamline cost processes for customers. By incorporating monetary companies immediately into the platform, prospects can get pleasure from a seamless checkout expertise with out the necessity to navigate to exterior web sites or cost gateways. This comfort not solely saves time but additionally reduces the danger of cart abandonment, resulting in elevated conversion charges for on-line retailers.

Improved Buyer Belief and Loyalty

Embedding monetary companies inside e-commerce platforms also can assist construct belief and loyalty amongst prospects. When customers can securely retailer cost info and full transactions throughout the identical platform, they’re extra prone to return for future purchases. Moreover, options similar to personalised suggestions based mostly on previous transactions and quick access to financing choices can improve the general purchasing expertise, fostering long-term relationships with the model.

Implementation of Embedded Finance in E-commerce

Implementing embedded finance options into e-commerce web sites includes a number of key steps to make sure a seamless integration. This course of requires cautious planning and execution to leverage the advantages of embedded finance successfully.

Integrating Embedded Finance Options

- Establish the monetary companies wanted: Decide the precise embedded finance options required based mostly on the e-commerce platform’s wants, similar to cost processing, lending choices, or insurance coverage companies.

- Select a dependable supplier: Choose a trusted monetary know-how accomplice with a confirmed monitor file in offering embedded finance options for e-commerce companies.

- API integration: Combine the monetary companies supplier’s APIs into the e-commerce platform to allow easy transactions and seamless consumer expertise.

- Testing and optimization: Conduct thorough testing to make sure the embedded finance options work accurately and optimize the combination for efficiency and safety.

Evaluating Approaches for Platform Scalability

- Customized integration: Tailoring embedded finance options to fulfill particular necessities can provide extra flexibility however could require extra assets and time for growth.

- Plug-and-play options: Utilizing pre-built modules or plugins for embedded finance can pace up the combination course of, however could have limitations in customization.

- Scalability concerns: Consider the scalability of the chosen method to make sure that the embedded finance options can develop with the e-commerce platform’s wants over time.

Challenges and Issues in Adopting Embedded Finance

- Regulatory compliance: Be sure that the embedded finance options adjust to related monetary laws to keep away from authorized points and shield consumer information.

- Safety issues: Tackle safety dangers related to monetary transactions by implementing sturdy encryption and authentication measures to safeguard delicate info.

- Consumer expertise: Steadiness the combination of embedded finance with the general consumer expertise of the e-commerce platform to offer a seamless and intuitive purchasing expertise for patrons.

Finest Practices and Case Research: What Are The Finest Examples Of Embedded Finance In E-commerce Platforms?

Embedded finance has revolutionized the best way e-commerce platforms function, resulting in larger effectivity and enhanced buyer experiences. Let’s discover some finest practices and case research of firms which have efficiently built-in embedded finance options.

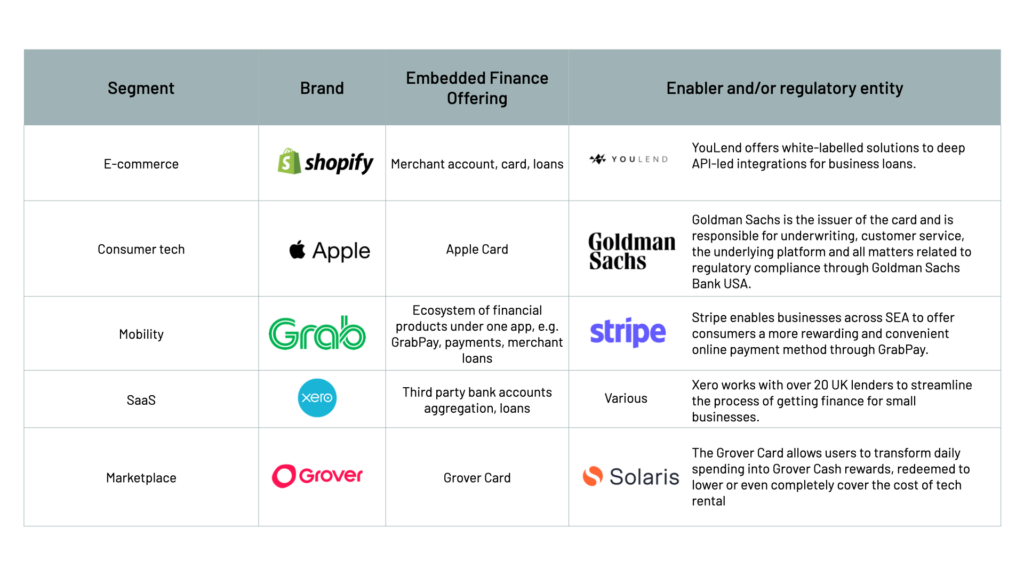

1. Shopify’s Integration with Stripe

Some of the notable examples of embedded finance in e-commerce is Shopify’s partnership with Stripe. By integrating Stripe’s cost processing capabilities immediately into their platform, Shopify has streamlined the checkout course of for retailers and prospects alike. This seamless integration has resulted in elevated gross sales and buyer satisfaction for Shopify customers.

2. Amazon Pay for Third-Get together Sellers

Amazon has leveraged embedded finance by Amazon Pay to offer third-party sellers on their platform with a safe and handy cost answer. With Amazon Pay, sellers can provide prospects a well-recognized and trusted cost technique, resulting in larger conversion charges and repeat enterprise. This has considerably boosted the expansion of small companies on Amazon.

3. Klarna’s Purchase Now, Pay Later Characteristic, What are the most effective examples of embedded finance in e-commerce platforms?

Klarna, a Swedish fintech firm, has reworked the e-commerce panorama with its “Purchase Now, Pay Later” function. By providing prospects the choice to separate their funds into installments at checkout, Klarna has elevated conversion charges and common order values for retailers. This progressive technique has set Klarna aside as a frontrunner in embedded finance.